Retail Media Networks: Beginner's Guide

Retail media networks (RMNs) have been gaining a lot of attention lately. With more and more consumers turning to online shopping, retailers are turning their owned-and-operated properties into ad platforms to offer advertisers and brands a new, efficient way to reach their target audiences.

In this retail media networks: beginner's guide, find answers to your top 10 pressing retail media questions and finally get up to speed so you can take advantage of the opportunity to generate new sales revenue.

Table of Contents

- What Is a Retail Media Network?

- How Popular Are Retail Media Networks?

- What Are the Top Retail Media Networks?

- Who Advertises on Retail Media Networks?

- What Does Retailer First-Party Data Include?

- How Do Retail Media Networks Work?

- Do Retail Media Networks Offer a Full-Funnel Strategy?

- Popular Retail Media Tactics

- What Are Some Retail Media Network Benefits?

- Retail Media Network Considerations

What Is a Retail Media Network?

A retail media network is a form of in-store advertising in a digital format on a retailer’s website, app or other digital properties where brands can advertise to consumers who are actively searching and shopping for certain products.

As consumer preferences have shifted to shopping online from in-store, retailers have transformed some of their promotional in-store displays and recreated them online in the form of RMNs to ensure that they can continue to offer these opportunities to brands and monetize from brands to offset low margins made from purchases.

To compete with Amazon, retailers have created their own retail media networks to diversify revenue streams and capture their own piece of the pie. Amazon started as a digital-first company with no in-store presence, which is how the powerhouse got ahead. Amazon is now learning the opposite, how to bring online to in-store with its recent ventures into brick-and-mortar stores.

RMNs help connect potential buyers with the products they are looking for, making online shopping a more personalized and effective experience. Think of RMNs as virtual shopping malls with extended digital shelves. RMNs offer brands the ability to reach audiences beyond their own and can include conquesting, category level, etc. Brands can use RMNs’ highly targeted advertising space to do the following:

- Advertise to target audiences with more precision.

- Improve campaign success.

- Drive more sales revenue.

The Retail Media Network Landscape: Fiercely Competitive, Continually Changing

But the competitive retail media landscape is dynamic and continually evolving. In fact, it seems every major retailer now has an RMN today: Amazon Advertising, Walmart Connect, Target Roundel, Kroger Precision Marketing and Dollar General Media Network (DGMN), to name a few. Even the smaller, more vertical-specific retailers also have RMNs — including Michaels.

The landscape keeps getting more crowded. Now, over 600 retail media networks span all merchant types — from digital-first operations, marketplaces, mass and discount merchandisers to grocers, department stores and delivery services and hotels. New players continually emerge while established players expand their offerings to stay ahead of the curve.

How Popular Are Retail Media Networks?

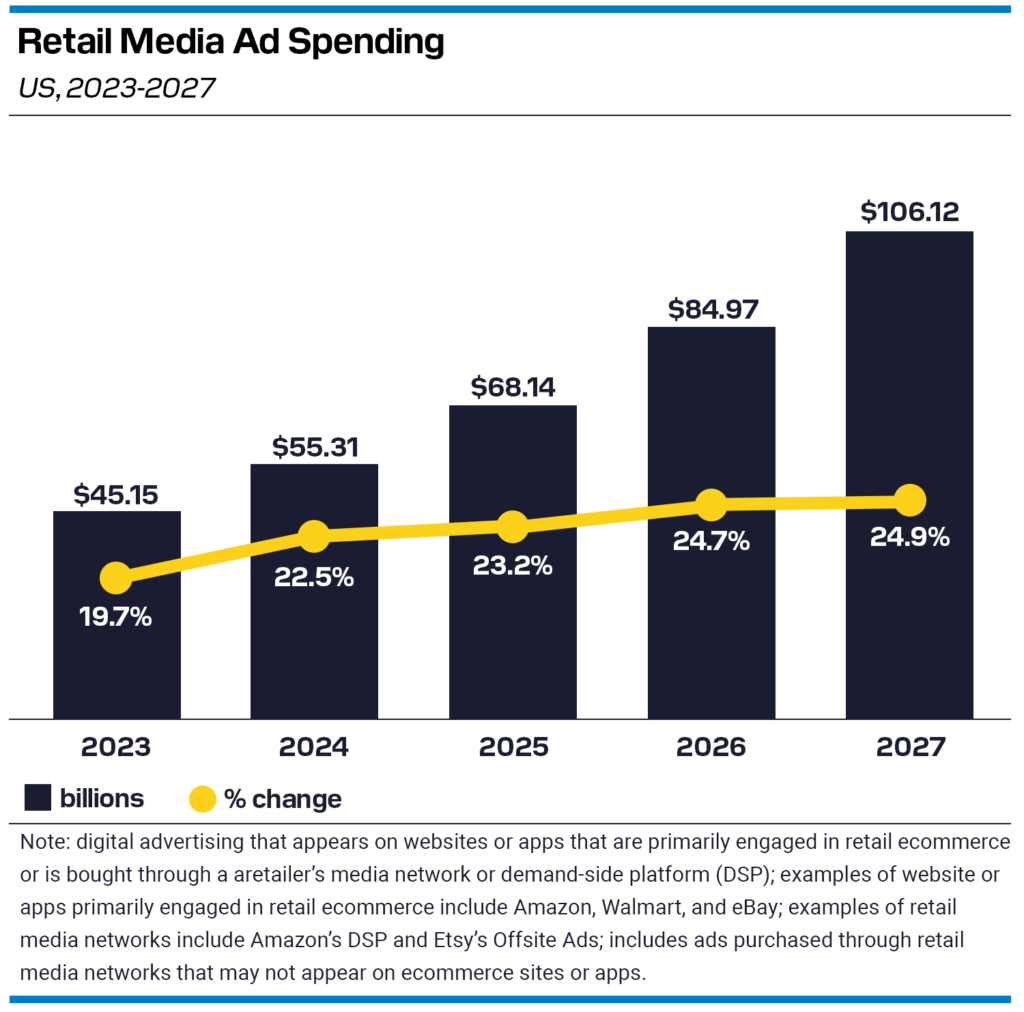

eMarketer recently forecast that U.S. retail media ad spending will surpass $45 billion this year. Guess what’s driving most of that spending? Search. By the end of 2027, retail media ad spending is predicted to make up more than a quarter of all U.S. digital ad spend.

Source: eMarketer, 2023

More Retail Media Statistics To Know

To get a better picture of the RMN ecosystem, check out these noteworthy facts:

Over Half of Marketers Used RMNs in 2022 as Part of Their Advertising Strategy

This trend is only expected to grow, with more marketers outside of consumer-packaged goods (CPG) brands adding RMNs to their media mix this year.

Amazon Advertising and Walmart Connect Are the Most Popular RMNs in the US

That’s according to a recent survey by Statista. Target Roundel, Kroger Precision Network, Instacart and Dollar General also made the list of the RMNs among U.S. marketers.

91% of Advertisers and Brands Use On-Site Advertising To Reach Consumers

According to this recent survey, 91% of them said they're running on-site advertising with retailers while 73% reported off-site display and 63% off-site video. They’re also sneaking into in-boxes with 48% using retailers’ email/newsletters and 46% catching consumers’ eyes with in-store digital out-of-home (DOOH) ads.

By 2024, About $1 of Every $6 Spent on Digital Ads in the US Will Go to Retail Media

Retail media is set to become the next big thing in digital media. By 2025, experts predict advertisers will actually spend more on retail media than on linear TV.

What Are the Top Retail Media Networks?

These five RMNs are dominating the retail world and are making strides now:

Amazon, making $34 billion this year (with 19% growth over last year), is on top of the game.

Walmart is giving Amazon a run for its money with U.S. revenues expected to grow 42%, and its physical presence is a win over Amazon.

Albertson’s and Kroger are two RMNs that are strong on their own but could be stronger together if their merger goes through in early 2024. Albertson's digital grocery sales were 33% YoY at the end of last year while Kroger's were 12%.

Instacart is seeing lots of success in digital grocery sales and is expected to grow 41.3% this year.

However, Klarna lets you buy something now and pay later in installments, and this fintech app is having a moment. In fact, Forbes named the ecommerce enablement platform the Best Overall “Buy Now, Pay Later” (BNPL) App.

Who Advertises on Retail Media Networks?

A wide range of companies advertises on retail media networks – from well-established national brands to emerging brands to online-only brands now making the shift from being direct to consumer to getting stocked on shelves. The ability to build custom audiences or target specific ones has made RMNs a huge draw for companies from all industries.

RMNs aren't only for CPG clients. They're a great strategy for brands that don’t have products on RMNs but are looking to replace behavioral targeting and third-party data. With RMNs, brands can test different audiences, gain insights they can’t get elsewhere, and align with users who have a brand affinity. For example, Patagonia buyers may also be interested in Trek Bikes.

What Does Retailer First-Party Data Include?

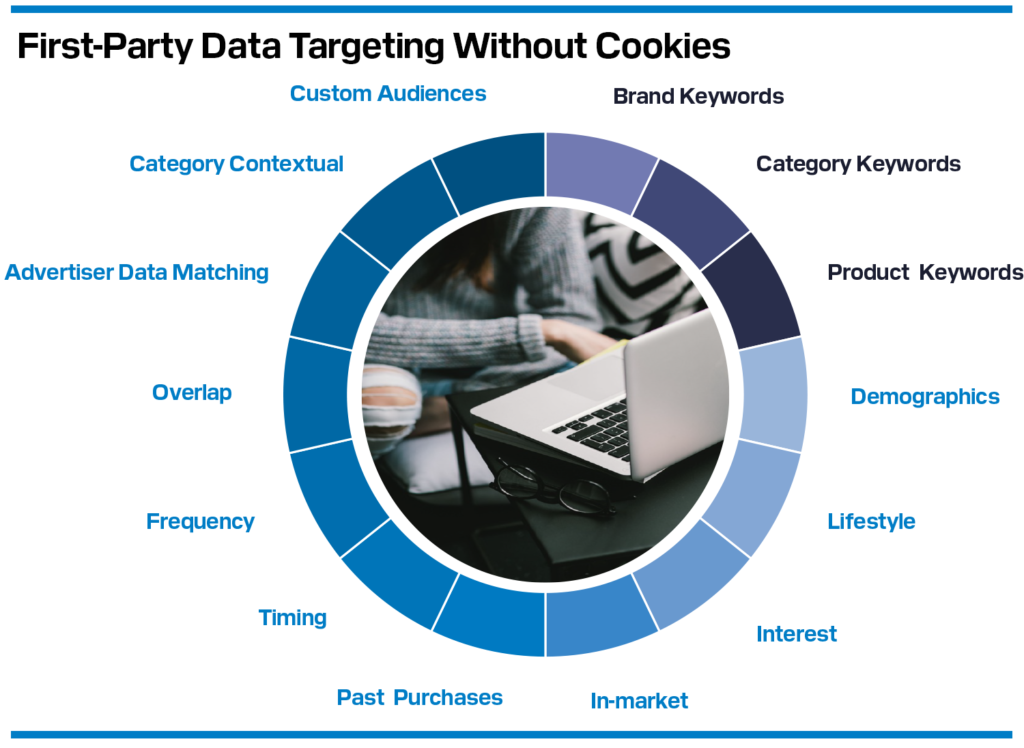

Retail media networks offer advertisers valuable data to help them better understand their brand audience and characteristics. Their first-party data is oftentimes collected from customers themselves. For example, when customers sign up for a loyalty program or sweepstakes, they're providing first-party data. Since it's from customers, the data is less prone to data inaccuracy and privacy compliance issues. But first-party data can also come from purchase data tied to a credit card.

First-party data typically comes from customer relationship management (CRM) systems, loyalty programs, website analytics and other online and offline touchpoints. It can include this and more:

- Demographics: Age, gender, household makeup, kids, life stage, etc.

- Lifestyle: Browsing and purchasing data, sortable by groups; think gadget geeks, new moms or outdoor enthusiasts.

- In-Market and Purchasing: Browsing and loyalty data, buying patterns and transactional history, and preferred payment methods.

- Contextual: Product or keyword targeting, see customers shopping for specific products, product categories or brands like yours in real time.

With retail media networks’ first-party customer data and advanced targeting, brands can develop more effective and personalized digital marketing campaigns. Matching data, they can cater to specific audiences and improve engagement, conversion rates and sales.

How Do Retail Media Networks Work?

Retailers monetize their website, app and other owned properties by allowing advertisers to bid on their ad space or buy their audience data.

- RMNs offer advertisers targeted on-site advertising opportunities such as native and display ads. Native ads, a.k.a. sponsored content, are ads designed to blend into a retail website’s or mobile app’s look and feel. While display ads are more traditional banner or video ads. Brands can advertise their products to consumers at the point of purchase.

- Advertisers can also bypass on-site advertising entirely and purchase retailer audience data – first-party data generated by loyalty programs as well as shopper and customer browsing history, online searches and more. With audience data, they can target specific audience groups and run off-site ad campaigns.

Retail Purchase Paths

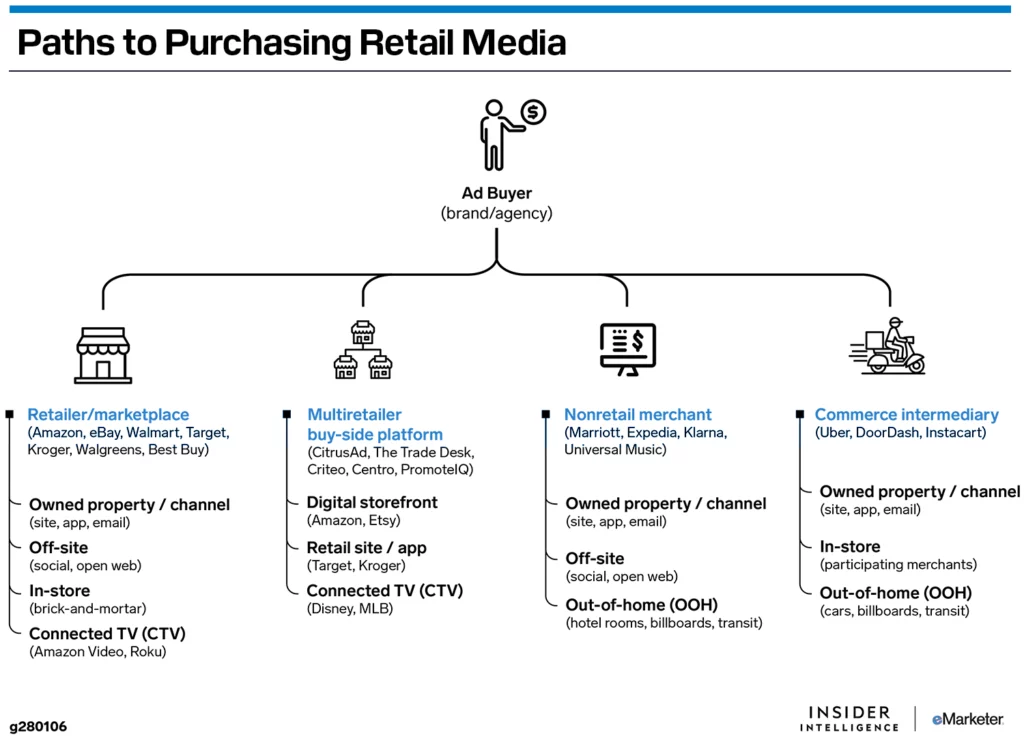

This eMarketer visual shows the retail media purchase paths now available.

Source: eMarketer, 2023

First are retailers/marketplaces, which offer a range of advertising options within their own ecosystems.

Next are multi-retailer buy-side platforms, which enable you to place ads across multiple retailers.

Outside the traditional retail sphere, you can work with hospitality brands, travel and hotel providers – such as Marriott, Expedia and the like.

Or use DoorDash, Instacart and other commerce intermediaries’ site data and targeting capabilities to create personalized ads that resonate with their massive customer bases at the time of purchase.

Whichever path you choose, retail media networks can help you achieve more brand visibility, awareness and more.

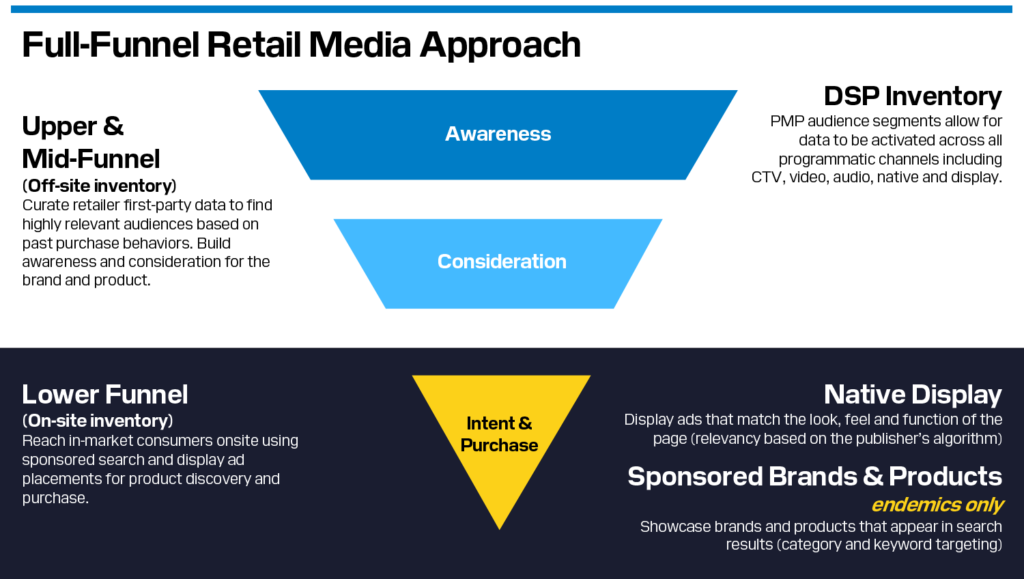

Do Retail Media Networks Offer a Full-Funnel Strategy?

Search is expected to be almost two-thirds of U.S. retail media ad spending this year. Most retail media advertising revenue comes from performance ads.

But retail media networks can optimize every aspect of a customer's journey through the purchase funnel including:

- Top - Building brand awareness, attracting and engaging prospective customers.

- Middle - Nurturing relationships and increasing purchase consideration.

- Bottom - Converting leads to customers.

This full-funnel RMN approach helps marketers better understand customers at each stage in their journeys. Then, they can tailor their messaging and tactics to suit customer needs, creating more effective campaigns and a better return on investment (ROI).

Popular Retail Media Tactics

Available retail ad units can include display, sponsored products, site search to video, CTV and apps to mobile to in-store tactics, email, direct mail and coupons and listings, among others. But not all units are available across all retailers or execution platforms.

Ad unit, data and targeting availability is dynamic and changing daily, making it a challenge to track all variables. That's why it's important to work with reps and planners who specialize in RMN strategies to get into lesser-known betas and nurture partnerships.

Here's a quick look at a few popular retail media tactics:

- Banner and Display Ads: These are targeted by data – such as browsing history, search keywords and purchasing behavior – and are shown on a retailer's website or app but can run off-site as well.

- Dynamic Ads: These are automatically personalized to show products or content relevant to users based on their search, browsing and viewing history, and these ads offer more personalized experiences.

- Sponsored Products: By promoting specific products on a retailer's website or app and driving more visibility by appearing in search results and targeted placements, brands can bid on sponsored product placements and use the data gathered to adjust and personalize ad placements.

- Sponsored Search Ads: By appearing at the top of organic search results and targeted to specific keywords entered by consumers, these ads are similar to Google Ads and are based on a range of factors.

- Video Ads: With the ability to target and pinpoint specific audiences, video advertising on retailer websites and mobile apps strives to maximize audience reach and engagement.

What Are Some Retail Media Network Benefits?

Retail media networks offer advertisers and brands a powerful tool for reaching their target audiences and driving greater sales and customer engagement. Here are a few benefits they provide:

- Targeted Advertising: Advertisers can better understand their customers' preferences, purchase cycle (or if they’re new to brand) and shopping behaviors – to create compelling ad campaigns that drive conversions and sales.

- Greater Visibility: RMNs offer brands greater visibility and exposure through high-traffic retail websites and apps.

- Enhanced User Experience: RMNs provide consumers with relevant, personalized advertising and recommendations that improve the user experience and brand loyalty.

- Data-driven Insights: RMNs provide data and analytics that help brands get insight into market share, track campaign performance, optimize their advertising efforts and understand how their advertising impacts transactions with closed-loop reporting.

- Increased ROI: RMNs help brands target consumers who are more likely to engage and purchase their products or services. Brands can gain valuable insights into their audience, choose optimal ad formats and placements and measure the effectiveness of their efforts – all of which leads to a more significant ROI.

Retail Media Network Considerations

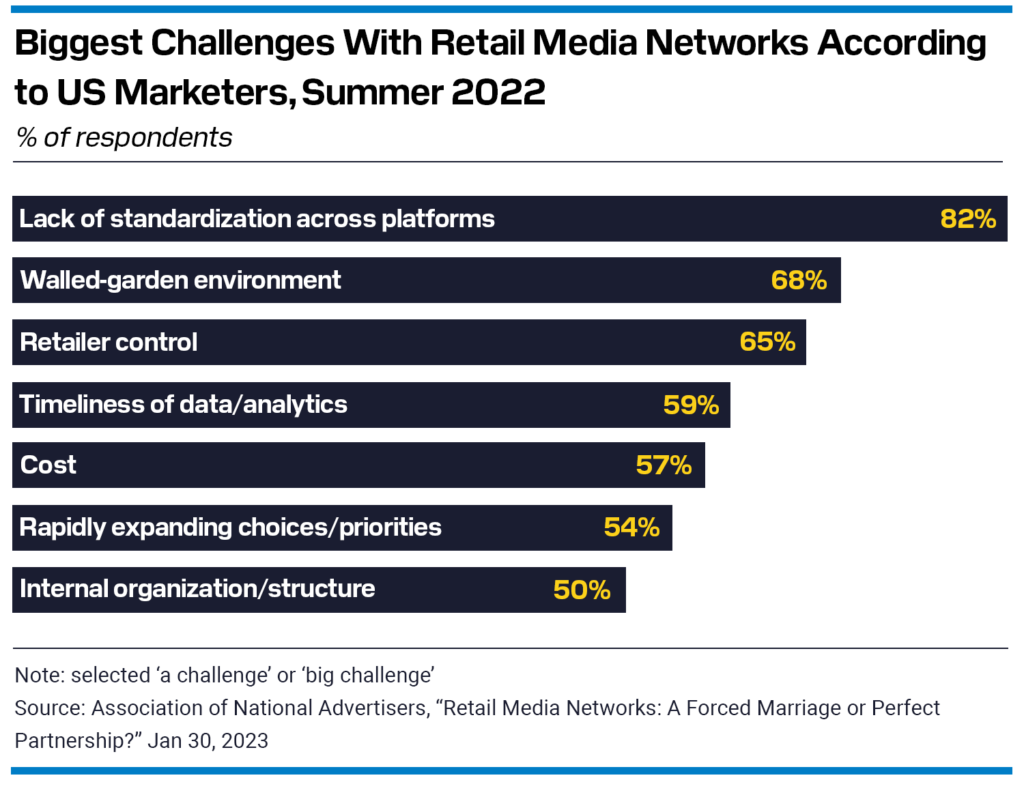

In eMarketer’s recent survey, 82% of respondents noted the lack of standardization across RMNs as their biggest challenge.

Source: eMarketer, 2023

Around 56% of brands advertise with anywhere from 5 to over 10 RMNs. Not working efficiently across the board and making apples-to-apples comparisons can be frustrating, time-consuming and unproductive. That’s why having a solid and knowledgeable retail media partner is key.

Goodway Group understands the retail media landscape and networks from all angles. Tap into all the benefits we offer from our innovative retail media network and industry relationships now. Get the deep programmatic media expertise and data science and analytics chops you need to stitch together, activate, execute and tie your retail media advertising campaign results to sales.

Want more? Learn about the future of retail media networks and how retail media networks impact the future of ecommerce. Now's the time to get in on the retail media action and reap the benefits of this ever-changing, up-and-coming digital media channel.