Top 14 B2C Digital Marketing Trends for 2025

From smaller brands having the opportunity to advertise at the Olympics to a charged and unpredictable political season to the continued dominance of retail media networks, 2024 has been jam-packed with changes and innovations at every turn. What can we expect in the digital marketing world in 2025?

Whether you’re a commerce brand, a retailer or an agency that services clients in the B2C space, we’re here to give you the insights you need for success. Use these top digital marketing trends to guide your planning, budgeting and forecasting for 2025.

Table of Contents:

Video Advertising Trends

1. Linear TV Ad Spending Will Shrink While CTV Ad Spending Will Grow

Throughout the rest of 2024, U.S. linear TV ad spending is expected to remain stable compared to 2023. This is despite the typical boost from events like the Olympics and the presidential election. This stagnation is attributed to ongoing cord-cutting trends. The outlook for 2025 is less optimistic, with a projected 13.3% year-over-year decline, echoing the 12.1% drop seen in 2023.

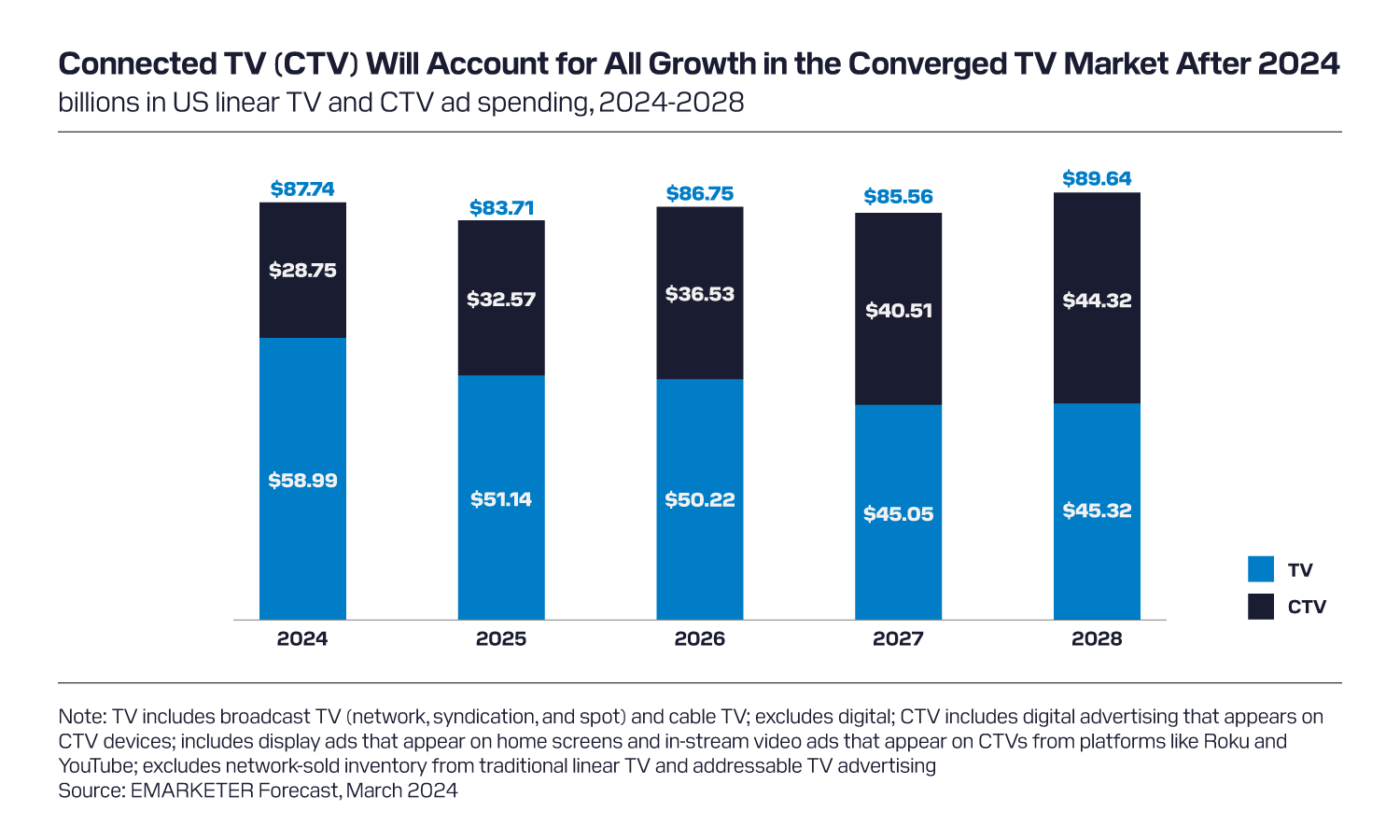

Meanwhile, CTV continues to gain traction among advertisers, steadily increasing its share of the total video advertising market. When EMARKETER first forecasted CTV ad spending in 2019, it represented just under 10% of combined linear TV and CTV ad expenditure. This year, CTV’s share is anticipated to reach approximately one-third of that total.

Looking ahead, projections suggest that CTV and linear TV ad spending will be nearly even by 2028, highlighting the shifting landscape of video advertising.

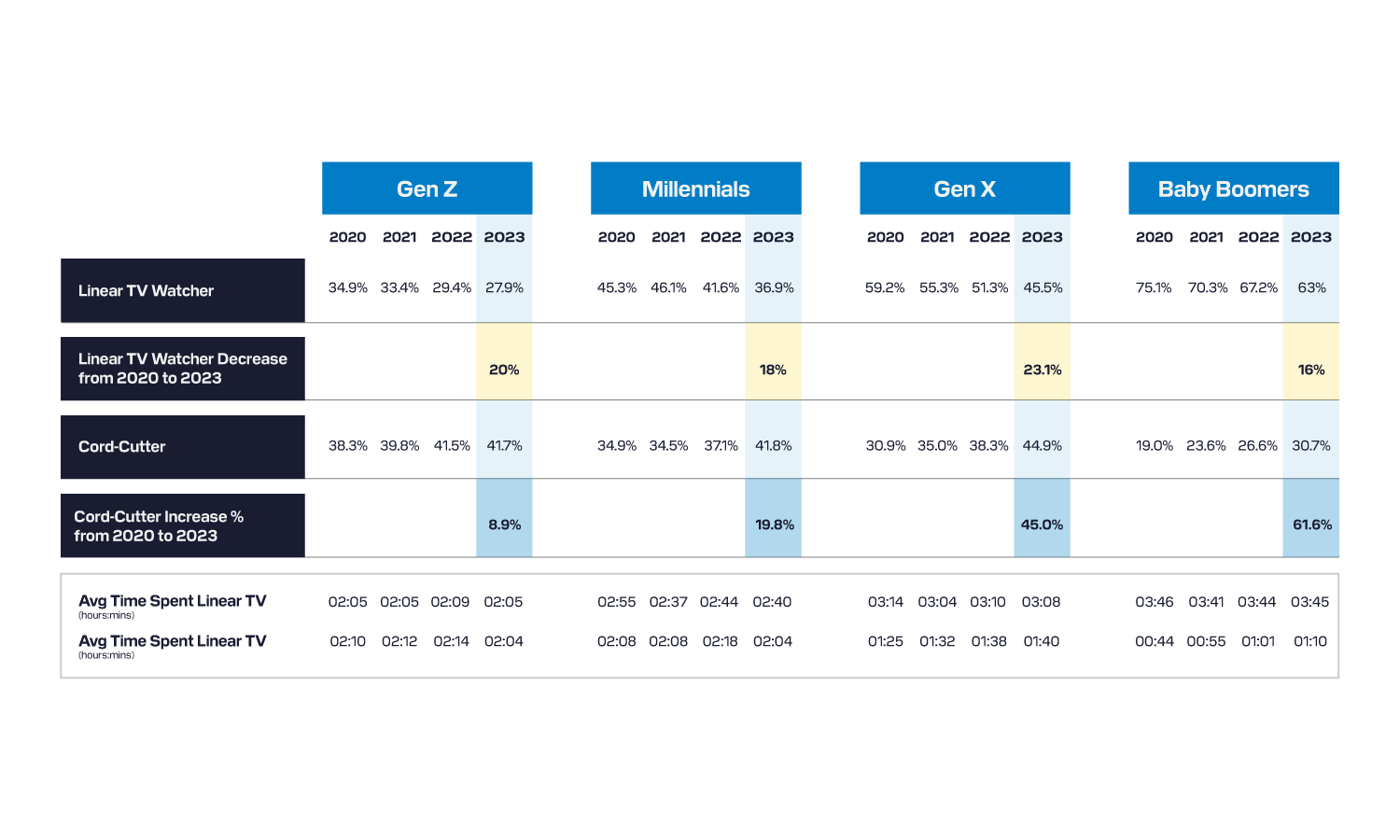

Data from GWI indicates that linear TV is more popular among baby boomers and Gen X, with only 37.1% of millennials and 27.9% of Gen Z indicating they watch linear TV. However, since 2020, 61% of baby boomers have become “cord-cutters” themselves.

2. Free Ad-Supported Streaming TV (FAST) Will Become More Popular

Ever since FAST launched in recent years, this type of streaming TV has experienced rapid growth. According to Nielsen, Gracenote Video Data reports over 1,900 individual FAST channels globally, with more than 1,300 in the U.S. alone. This represents a significant 30% increase from mid-2023, when there were only 1,000 U.S. channels. Major FAST platforms like Pluto TV, Amazon’s Freevee and Tubi offer hundreds of channels each, providing viewers with extensive choices.

Viewer engagement with FAST content is also on the rise. In February 2024, Pluto TV, Tubi and the Roku Channel collectively accounted for 3.7% of the total TV usage. This growth in viewership is attracting more advertising revenue. Digital TV Research Ltd. projects that global FAST revenue will more than double to $18 billion by 2028, highlighting the sector’s increasing importance in the streaming landscape.

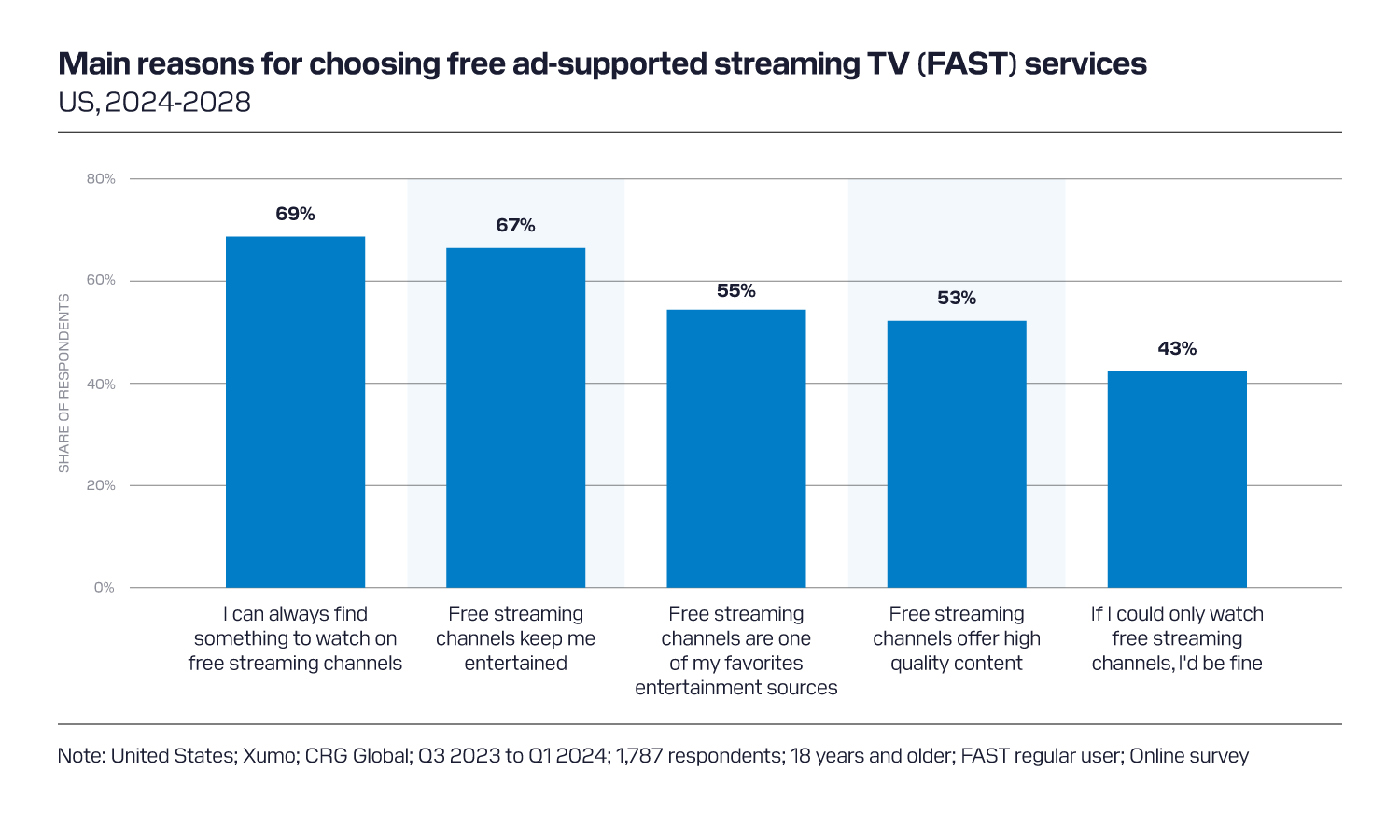

Survey data from Statista indicates that over half (53%) of FAST users indicate that free streaming channels offer high-quality content, and 69% stated they can always find something to watch.

3. Advertising-Based Video On-Demand (AVOD) Will Also Grow in 2025

Per Statista, the AVOD market has experienced substantial growth recently, fueled by the rising popularity of online streaming platforms. These platforms offer viewers diverse content options with convenience and flexibility, creating an expanding audience for advertisers.

AVOD presents distinct advantages over traditional advertising methods — particularly in its ability to target specific audiences based on interests, demographics and viewing habits. This precision enhances ad effectiveness and engagement.

Two key trends are shaping the AVOD landscape:

- Programmatic advertising adoption: This data-driven, algorithmic approach to ad buying and selling has increased efficiency, scalability and effectiveness in AVOD advertising.

- Ad-supported streaming services: These platforms offer free access to premium content in exchange for ad viewing, attracting large audiences while generating advertiser revenue.

The AVOD sector is poised for significant financial growth, with industry revenue projected to increase from $48 billion in 2024 to over $60 billion by 2027.

Social Media Trends

4. Platform Popularity Will Continue To Vary by Age Group

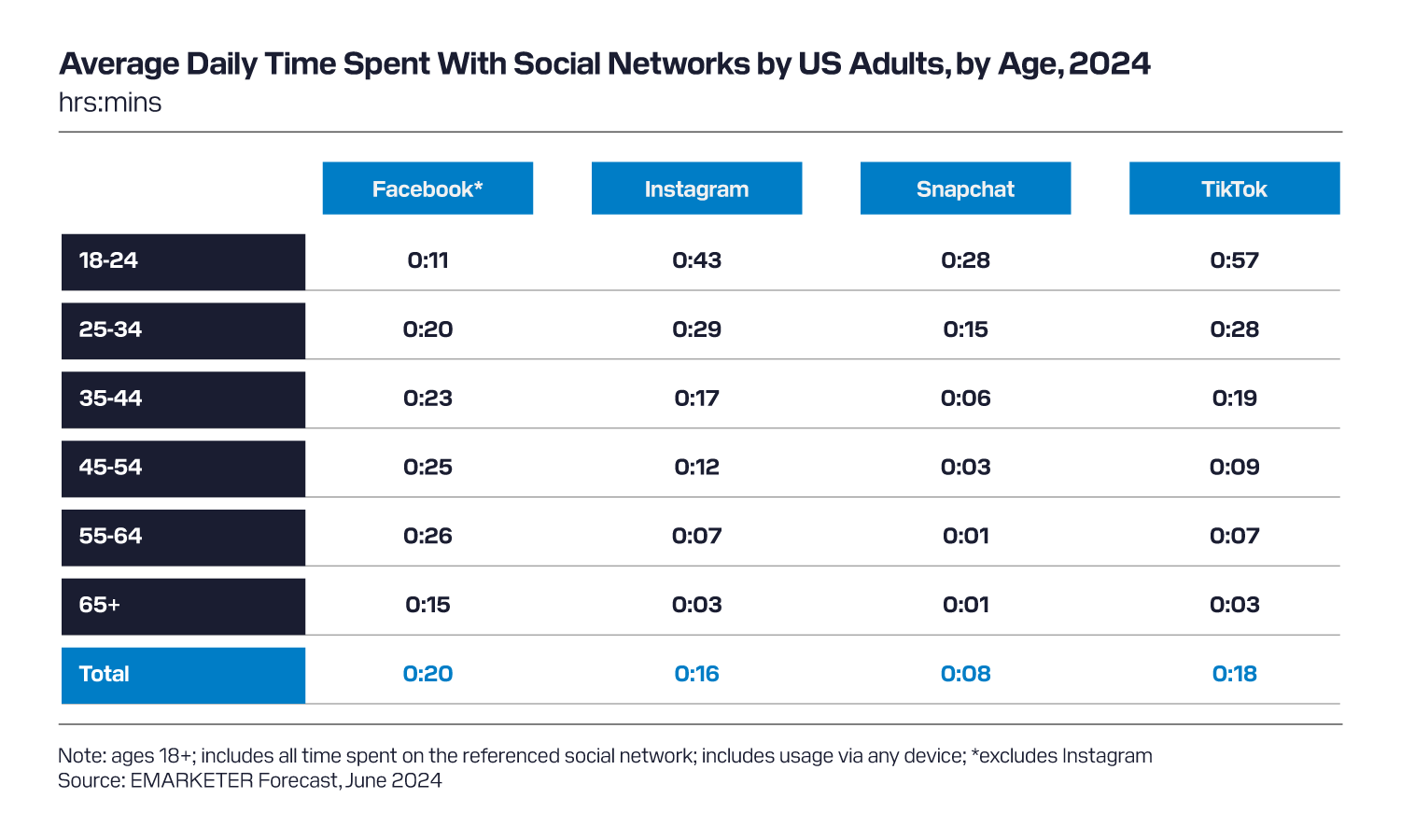

EMARKETER data reveals that approximately two-thirds of Americans use social media, with platform preferences varying significantly across age groups. Gen Z and millennials tend to engage with multiple platforms, while older generations predominantly favor Facebook. Children under 12 primarily use YouTube.

Social media adoption is growing across all generations, with current usage reaching 67.9% of the U.S. population. The generational divide is evident in the usage rates:

- Baby boomers: 53.9%

- Gen Z: 87.9% (projected to reach 94.5% by 2028)

Recent trends show Gen Z driving significant growth across Meta’s platforms. Their increasing engagement with Facebook is primarily practical, centered around features like Facebook Marketplace for shopping. On Instagram, Gen Z is poised to overtake millennials as the dominant user group.

The social media landscape is evolving in other areas as well. X (formerly Twitter) has managed to slow its user decline, stabilizing its position in the market. Meanwhile, Reddit continues to experience growth, attracting active users across various age demographics.

5. Consumers Will Use Social Media for Search

A new survey from Forbes Advisor and Talker Research reveals a significant transformation in search behavior across generations. The study of 2,000 Americans found that social media platforms are becoming primary search tools for many people. Specifically, Gen Z is 25% less likely to use Google for searches compared to Gen X.

Only 64% of Gen Z use search engines for brand discovery, compared with the 94% of baby boomers who do so. But there’s a bright spot for Google: 57% of people use YouTube to search for information in the same way they use Google. The shaping nature of how people search for new brands will most likely continue in 2025.

Check out the three essential elements for a full-funnel search strategy to learn how to develop a search strategy based on this reality.

6. TikTok Will Remain Popular Despite the Potential Ban

This year, the U.S. Department of Justice (DOJ) referred to TikTok as a security threat because TikTok issued a lawsuit in an attempt to block a forthcoming U.S. ban. This agency argued that the Chinese government could mandate that TikTok share sensitive information with it. TikTok and ByteDance, its parent company, sued the ban in turn, saying it violated the First Amendment. In response, the DOJ said the First Amendment doesn’t apply to them.

Though no date is on the horizon for the suit against the DOJ, TikTok is leveraging numerous tactics to sway opinions including lobbying and paying lawyers up to $1,500 per hour to prep for court.

Despite the political news about TikTok, this platform retains its popularity. Per EMARKETER, TikTok usage is predicted to grow by 35.4% in 2025 to an estimated total of 122.7 million users. Meanwhile, TikTok ad revenues are also anticipated to increase in 2025 by 21.3%, reaching $12.65 billion.

7. Facebook’s Performance Will Be Mixed

Facebook usage is predicted to decrease with every generation except Gen Z users, which are expected to increase from 49% of the cohort (33.9 million users) in 2024 to 56.9% (40.5 million users) in 2029 according to EMARKETER. This is mainly driven by utilitarian purposes as mentioned before — i.e., Facebook Marketplace usage. Still, Gen Z doesn’t have as many users or spend as much time using the app as their Gen X and millennial counterparts. Moreover, the time spent on the app is predicted to go down for users under the age of 55.

8. Instagram Will Grow in 2025

Instagram users are predicted to grow by 43.2% (148.7 million people) in 2025, continuing an upward momentum. Instagram ad revenues will grow 13.6% in 2025, reaching a total of $35.16 billion. Per a Socialinsider study, Reels have an average reach rate of 30.81% — double the reach rate of other content formats. Reels impressions also perform better than that of other formats, with 2x more impressions.

9. YouTube Will Do Well With Younger Consumers and Experience Growth Overall

70% of Americans watch YouTube once per month on average, with the viewer penetration highest among users 12 to 34. Still, most Gen Alpha viewers (under age 12) will engage with YouTube only (as we mentioned before), while older generations will use YouTube among other platforms. EMARKETER estimated that 58% of children ages 0 to 11 watch YouTube, even though YouTube has a ban on children under the age of 13 having an account without parental consent.

YouTube also dominates the streaming TV space; according to a May 2024 Nielsen report, YouTube had the highest amount (9.7%) of viewership in the U.S., above Netflix. YouTube viewership is predicted to grow by 71.5% in 2025 to 245.9 million viewers. YouTube ad revenues will also grow in 2025 by 15.2%, reaching $9.56 billion.

It’s also worth noting that YouTube is trying to prevent ad blockers from being used on the platform.

Measurement Trends

Check out these 2025 measurement trends as you outline your measurement plans.

10. KPIs B2C Businesses Should Track in 2025

The following KPIs have proved successful for advertisers in 2024 and will continue to demonstrate the efficacy of your marketing campaigns in 2025:

- Conversion rate

- Customer lifetime value (CLV)

- Customer retention rate and quality

- Lead quality

- ROI

- Sales revenue

- Website traffic

Upper-Funnel Metrics

If you’re working on an upper-funnel campaign for a new brand launch in 2025, focus on measuring your email subscription rate as well since it provides insight into how many visitors want to receive offers and updates. In addition, consider using brand awareness surveys to measure the level of brand recognition and recall among your target audience.

Lower-Funnel Metrics

Doing a lower-funnel marketing campaign? Add these metrics to your mix to ensure you’re capturing all the data you can about prospects who are closer to making a purchase decision:

- Average order value (AOV)

- Churn rate

- Cost per acquisition (CPA)

- Lead-to-customer conversion rate

- Repeat purchase rate

- Return on advertising spend (ROAS)

- Shopping cart abandonment rate

11. Watch Out for These Key Benchmarks in Your Reporting

Though benchmarks for the KPIs listed above aren’t available for every industry, here are some B2C-specific benchmarks commonly used you can expect to see carry over into 2025:

- CLV: This can vary significantly depending on the industry and business model. However, a healthy CLV is typically several times higher than the cost of customer acquisition (CAC).

- Churn rate: The average annual churn rate for B2C businesses is around 20% to 30%.

- Ecommerce conversion rate: The average conversion rate for ecommerce websites is around 2% to 4%. This means that out of every 100 visitors to the website, 2 to 4 of them make a purchase.

- ROAS: For B2C businesses, a ROAS of 4:1 or higher is often considered a good benchmark. This means that for every $1 spent on advertising, the business generates $4 in revenue.

- Social media engagement rate: On social media platforms, a 1% to 5% engagement rate (likes, shares and comments) is considered reasonable for B2C brands.

12. Three Measurement Tactics Will Provide a Broader View of Outcomes

Last year, we discussed how B2C marketers would use multi-touch attribution (MTA) and incrementality testing in 2024 to fully capture the results of their marketing campaigns. Things will slightly shift in 2025. Although Google ultimately halted its plans to deprecate third-party cookies in July after shifting timelines several times in 2024, privacy legislation and trends — plus the problems with relying too heavily on probabilistic third-party cookies, which are brittle and unreliable forms of measurement — are causing traditional cookie-dependent MTA to lose its relevancy.

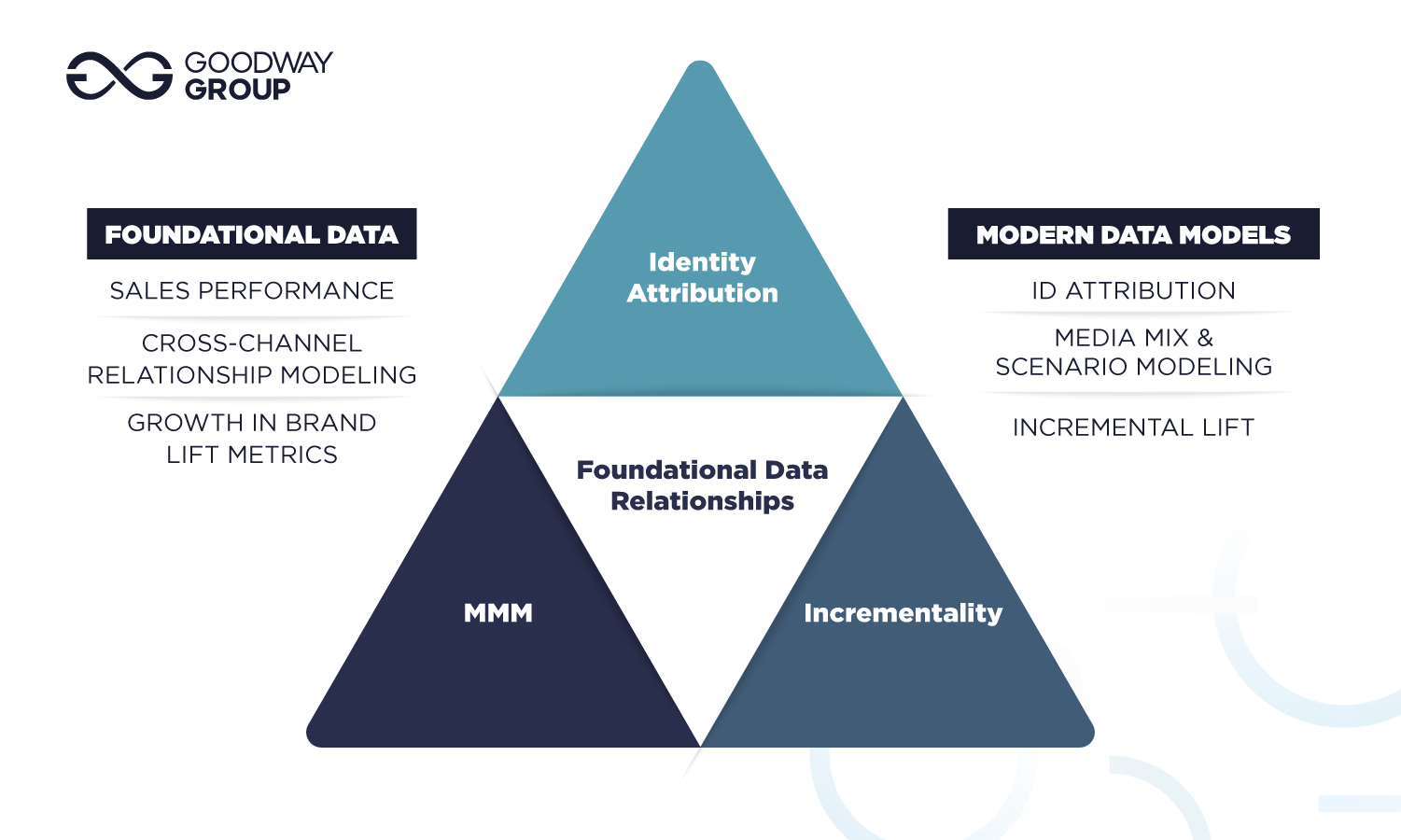

Instead, the future of B2C measurement will hinge upon three measurement tactics:

- The first is ID attribution. B2C brands will combine first-party data with performance metrics and clean room environments to demonstrate purchase behavior and media engagement across the funnel and open additional audience insights.

- The second is media mix modeling (MMM). Brands will use MMM to identify opportunities to invest in channels that have the potential to scale without hitting diminishing returns.

- The third is incrementality, which will still remain a powerful measurement methodology in 2025, as it did in 2024, and validates opportunities ahead of the total market launch and shows if marketing is driving new customers beyond those the brand was likely to gain without media present.

Retail Media Trends

13. Retail Media Networks (RMNs) Will Continue Their Upward Ascent in 2025

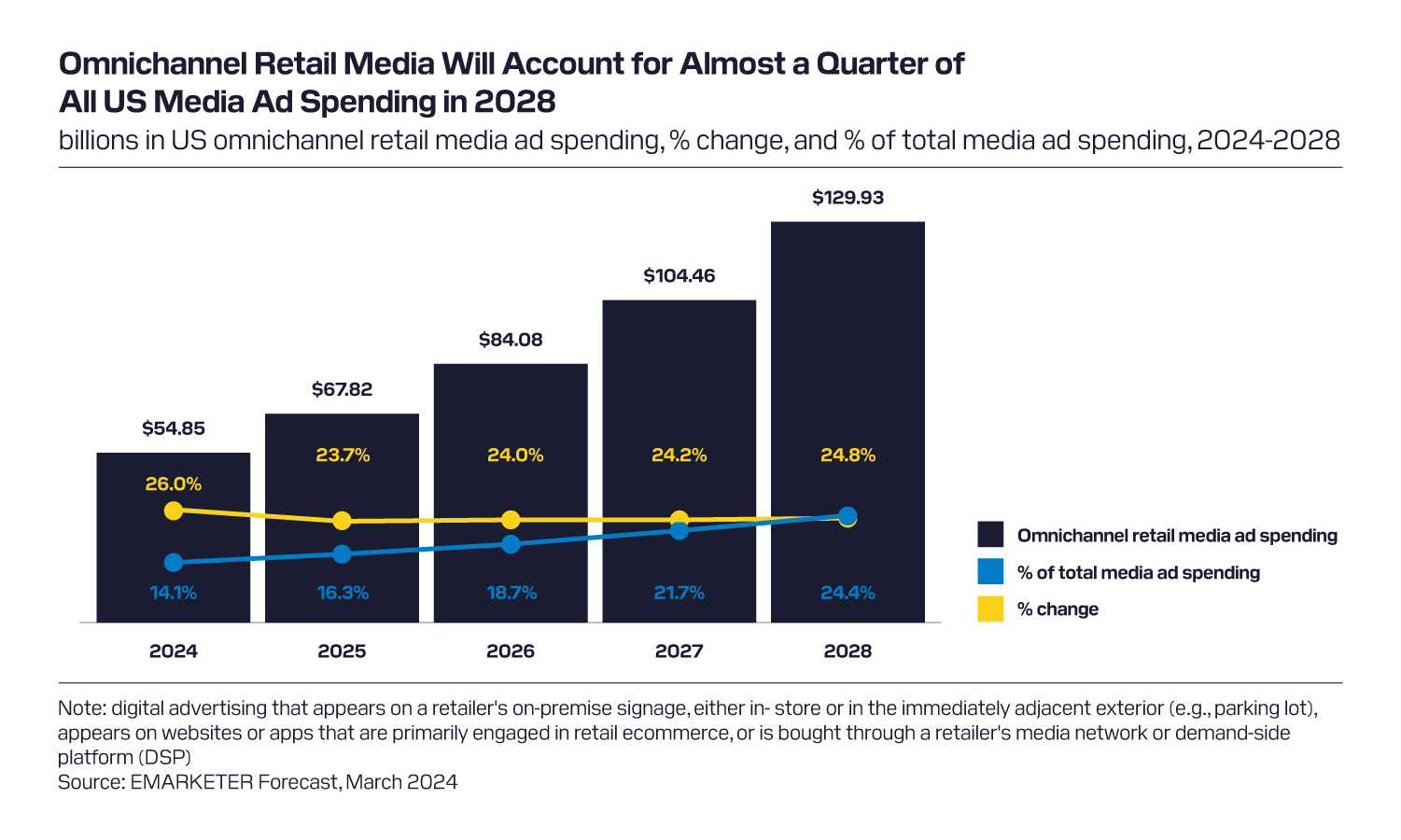

Retail media's importance is rising for U.S. advertisers per EMARKETER. 81% consider it “very important” or higher, outranking other channels according to December 2023 research from Skai and Path to Purchase Institute. Off-site retail media ad spending is expected to increase to $28.05 billion by 2028, driven mainly by CTV. In 2025, omnichannel retail media ad spending will increase to $67.82 billion. Retail media is set to be a top, fast-growing U.S. ad channel through 2028, despite slight forecast adjustments.

14. Retail Media CTV Ad Spending Will Continue To Grow

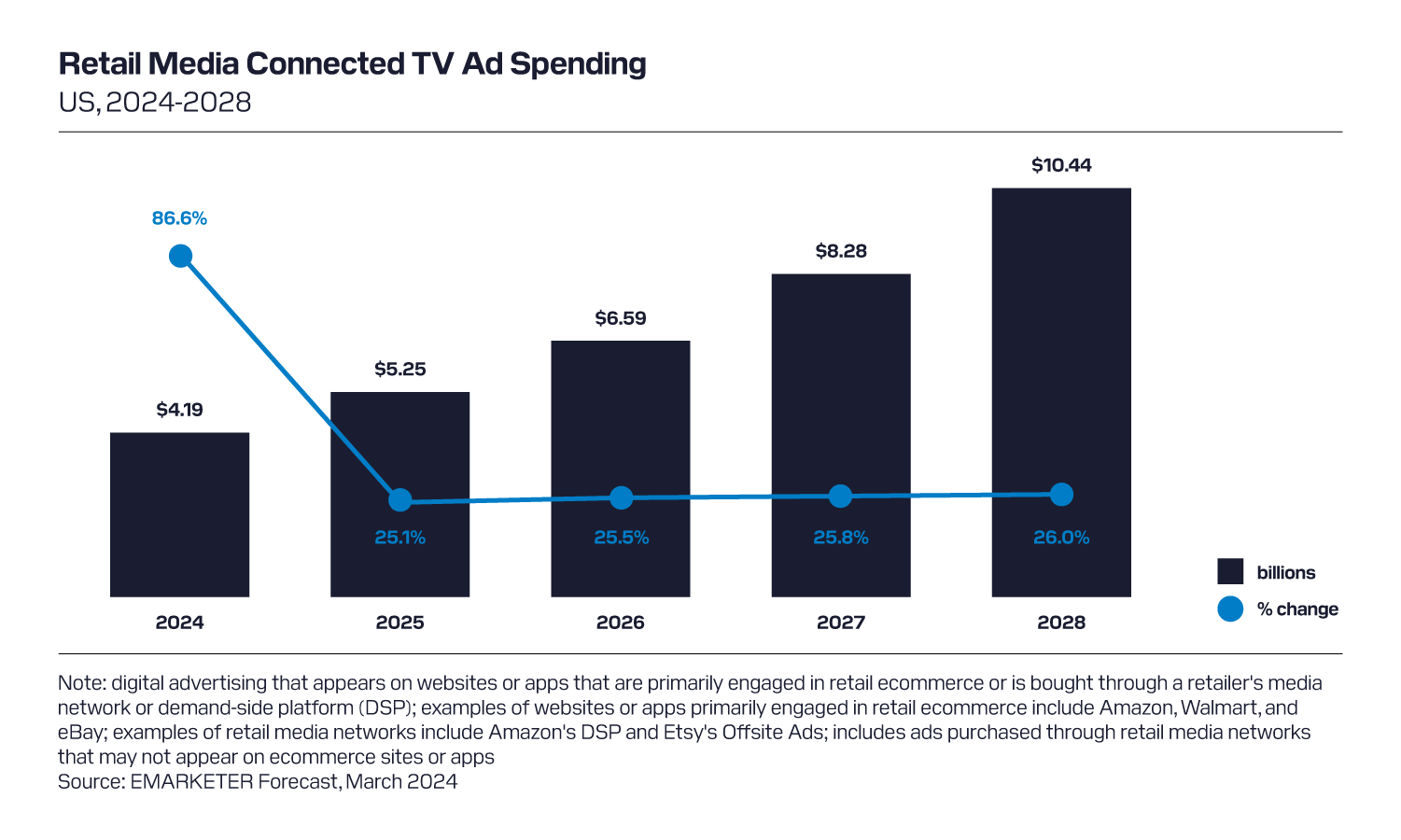

Retail media data enhances CTV advertising effectiveness. Jeffrey Bustos, IAB VP of measurement, addressability and data, explained: “With retail media data, [CTV advertisers are] able to get that closed-loop measurement that doesn't just tell you if someone saw the ad, but it also tells you what they did after they saw the ad.”

CTV ads offer more precise targeting, allowing advertisers to reach specific audiences like parents rather than broad demographics. However, retail media benefits from CTV's wider reach, complementing bottom-of-funnel website ads with top-of-funnel exposure where consumers spend time, creating a full-funnel approach

Because of these benefits, retail media CTV ad spending is predicted to increase in 2025 by 25.1%, reaching $5.25 billion.

More Resources To Power Your 2025 Planning

With this information, you should have a good starting point to begin planning your 2025 marketing campaigns and initiatives. For more insights, check out the following resources: